The AD-AS Model

The AD-AS model shows the relationship between output $(Y)$ and the price level $(P)$. Different to the IS-LM model, in this case $P$ is endogenous and varies with different levels of $Y$. The AD-AS model has three components:

- AD: Aggregate demand

- LRAS: Long-run aggregate supply

- SRAR: Short-run aggregate supply

The AD-AS model is more general than the IS-LM model in the sense that it allows for the price level to change. There are two other differences between these models. The first one is that while the AD-AS model allows for the interest rate $(i)$ to change, it does not show up explicitly in the model as it does in the IS-LM framework. The second one, is that both, monetary and fiscal policy affect the same line (the $AD$), while in the IS-LM framework monetary and fiscal policy shift different lines.

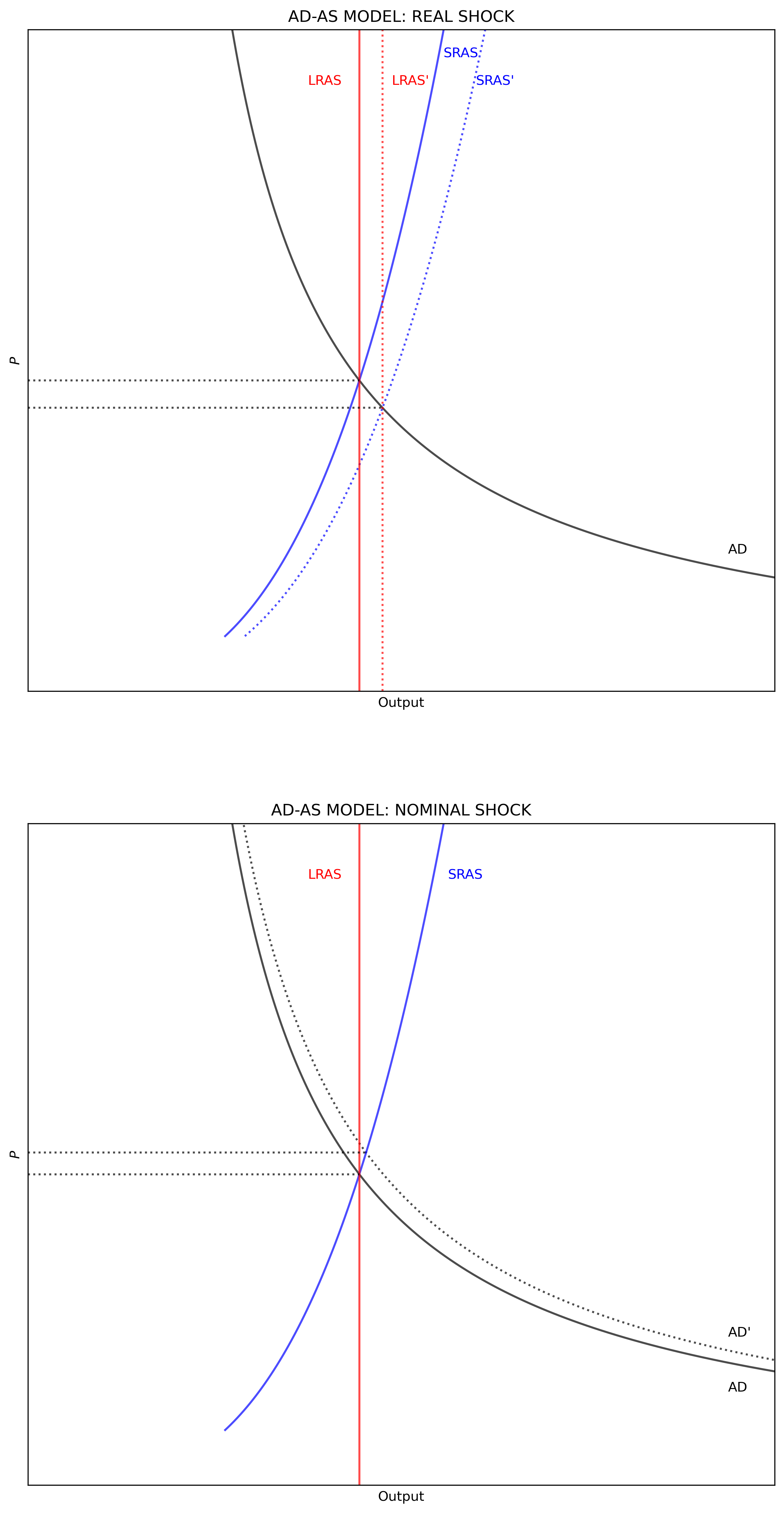

Aggregate Demand (AD)

The $AD$ line tracks all the output and price level combinations assuming the IS-LM model is in equilibrium. Graphically, it shows how equilibrium moves in the IS-LM graph when $P$ changes. A change in $P$ shifts the LM schedule giving a new equilibrium point on the IS schedule. In simple terms: $AD = Y = C + I + G + (X - Z)$ where $C$ is the household consumption, $I$ is investment, $G$ is government spending, $X$ is exports, and $Z$ is imports.

In the IS-LM model note there is a consumption function, an investment function, and an imports function. The remainig variables $(G = \bar{G} \text{ and } X = \bar{X})$ are treated as exogenous. The consumption, investment, imports, and money demand functions are:

$$ \begin{align} C &= a + b(Y-T) \\[10pt] I &= \bar{I} - di \\[10pt] Z & = \alpha + \beta \cdot (Y-T) \\[10pt] M^d &= c_1 + c_2 Y - c_3 i \end{align} $$

Where $a>0$ and $b \in (0, 1)$ are the household level of autonomous consumption and the marginal propensity to consume respectively. $T$ representing the nominal value of taxes; $I_0$ is the level of investment when $i = 0$ and $d >0$ is the slope of investment with respect to $i$; $\alpha >0$ and $\beta \in (0, 1)$ are the autonomous level and the marginal propensity to import respectively; and $c_1>0, c_2>0, c_3>0$ capture the keynesian precautionary, transaction, and speculation reasons to demand money.

$AD$ is the equilibrium level of output $(Y^*)$ from the IS-LM model, which is a function of $(P)$. From the IS-LM model note:

$$ \begin{align} Y^* =& \frac{\left[(a-\alpha)-(b-\beta)T + I_0 + G + X \right]/d + (1/c_3) \left(M^S_0/P - c_1 \right)}{(1-b+\beta)/d - (c_2/c_3)} \\[10pt] Y^* =& \underbrace{\left[\frac{(a-\alpha)-(b-\beta)T + I_0 + G + X}{d} - \frac{c_1}{c_3} \right] \left[\frac{1-b+\beta}{d} - \frac{c_2}{c_3} \right]^{-1}}_\text{vertical level} + \\[10pt] & \underbrace{\frac{M^S_0}{c_3} \left[\frac{1-b+\beta}{d} - \frac{c_2}{c_3} \right]^{-1}}_\text{shape} \frac{1}{P} \end{align} $$

Even though the function looks complicated, note that the relationship between $Y$ and $P$ is hyperbolic. Note that an increases in $M^S_0$ increases the level of Y but also changes the shape of $AD$.

Money supply and velocity

The AD-AS model has a real variable $(Y)$ and a nominal variable $(P)$. Because $PY = NGDP$ the model can be framed in terms of the equation of exchange.

$$ \begin{equation} MV_{Y} = P_{Y}Y \end{equation} $$

Where $M$ is money supply (shown as $M^S_0$ above), $V_Y$ is the velocity of money circulation, and $P_{Y}$ is the GDP deflator of real output $Y$. Note this simple form, $Y = \frac{MV_Y}{P_Y}$ also has the hyperbolic shape discussed above.

To add a layer of complexity, money supply can be open in base money $(B)$ times the money-multiplier $m$:

$$ \begin{align} m &= \frac{1 + \lambda}{\rho + \lambda} \\[10pt] M &= Bm \\[10pt] BmV_Y &= P_Y Y \end{align} $$

where $\lambda \in (0, 1)$ is the currency-drain ratio (cash-to-deposit ratio) and $\rho \in (0, 1)$ is the reserve ratio (desired plus required level of reserves).

If money demand $M^D$ is a $k$ proportion of nominal income $(P_Y Y)$, then, assuming equilibrium in the money market, money velocity is the inverse of money demand: $V_Y = 1/k$. As less (more) money is demanded to be hold as a cash-balance, the more (less) quickly money moves (in average) in the economy.

$$ \begin{align} M^S_0V_Y &= P_YY \\[10pt] M^D &= k \cdot \left(P_YY \right) \\[10pt] M^S_0 &= M^D \\[10pt] V_Y &= \frac{1}{k} \end{align} $$

We can code $AD$ with a class. A class allows to build our own type of objects. In this case the code constructs a class called AD that has (1) the money multiplier, (2) the money supply, and (3) estimates $AD$ for a given $P$.

The code follows the following structure. The first section imports the required packages. The second section builds the $AD$ class. The third section show the values of the money multiplier and total money supply. The fourth section plots the $AD$.

The class is build the following way. The first element, __init__ collects the model (or class) parameters. Note that the values of these parameters are defined inside the class (this does not need to be the case) and that these parameters exist inside the class (they are not global values). After the parameters are defined, the class continues to build the three components. Note that the first two (money multiplier and money supply) can be defined with the parameters already included in the class. The third component, the value of $AD$, requires an exogenous value, $P$.

#%% *** CELL 1 ***

"============================================================================"

"1|IMPORT PACKAGES"

import numpy as np # Package for scientific computing

import matplotlib.pyplot as plt # Matplotlib is a plotting library

from scipy.optimize import root # Package to find the roots of a function

"============================================================================"

"2|PARAMETERS"

# Model parameters

dpi = 300

"============================================================================"

"3|BUILD AD CLASS"

class class_AD:

"Define the parameters of the model"

def __init__(self, a = 20 , # AD: autonomous consumption

b = 0.2 , # AD: marginal propensity to consume

alpha = 5 , # AD: autonomous imports

beta = 0.1 , # AD: marginal propensity to import

T = 1 , # AD: Taxes

I = 10 , # AD: Investment

G = 8 , # AD: Government spending

X = 2 , # AD: Exports

d = 5 , # AD: Investment slope

c1 = 175 , # AD: Precautionary money demand

c2 = 2 , # AD: Transactions money demand

c3 = 50 , # AD: Speculatio money demand

B = 250 , # AD: Base money

lmbda = 0.05 , # AD: Currency drain ratio

rho = 0.10 ): # AD: Reserve requirement)

"Assign the parameter values"

self.a = a

self.b = b

self.alpha = alpha

self.beta = beta

self.T = T

self.I = I

self.G = G

self.X = X

self.d = d

self.c1 = c1

self.c2 = c2

self.c3 = c3

self.B = B

self.lmbda = lmbda

self.rho = rho

"Money multiplier"

def m(self):

#Unpack the parameters (simplify notation)

lmbda = self.lmbda

rho = self.rho

#Calculate money multiplier (m)

return ((1 + lmbda)/(rho + lmbda))

"Money supply"

def M(self):

#Unpack the parameters (simplify notation)

B = self.B

#Calculate M

return (B*self.m())

"AD: Aggregate demand"

def AD(self, P):

#Unpack the parameters (simplify notation)

a = self.a

alpha = self.alpha

b = self.b

beta = self.beta

T = self.T

I = self.I

G = self.G

X = self.X

d = self.d

c1 = self.c1

c2 = self.c2

c3 = self.c3

#Calculate AD

AD_level1 = (((a-alpha) - (b-beta)*T + I + G + X)/d - c1/c3)

AD_level2 = ((1-b+beta)/d - c2/c3)**(-1)

AD_shape = self.M()/c3 * ((1-b+beta)/d - c2/c3)**(-1)

return (AD_level1 * AD_level2 + AD_shape/P)

"============================================================================"

"4|SHOW RESULTS"

out = class_AD()

print("Money multiplier =", round(out.m(), 2))

print("Money supply =" , round(out.M(), 2))

"============================================================================"

"5|CREATE MODEL DOMAIN AND POPULATE AD"

size = 50

P = np.linspace(1, size, size*2)

Y = out.AD(P)

"============================================================================"

"6|PLOT AD"

### AXIS RANGE

y_max = np.max(P)

x_max = np.max(Y)

axis_range = [0, x_max, 0, y_max]

### BUILD PLOT

fig, ax = plt.subplots(figsize=(10, 8), dpi=dpi)

ax.set(title="AGREGGATE DEMAND", xlabel="Y", ylabel="P")

ax.plot(Y, P, "k-")

### AXIS

ax.yaxis.set_major_locator(plt.NullLocator()) # Hide ticks

ax.xaxis.set_major_locator(plt.NullLocator()) # Hide ticks

### SETTINGS

plt.axis(axis_range)

plt.show()

Money multiplier = 7.0Money supply = 1750.0

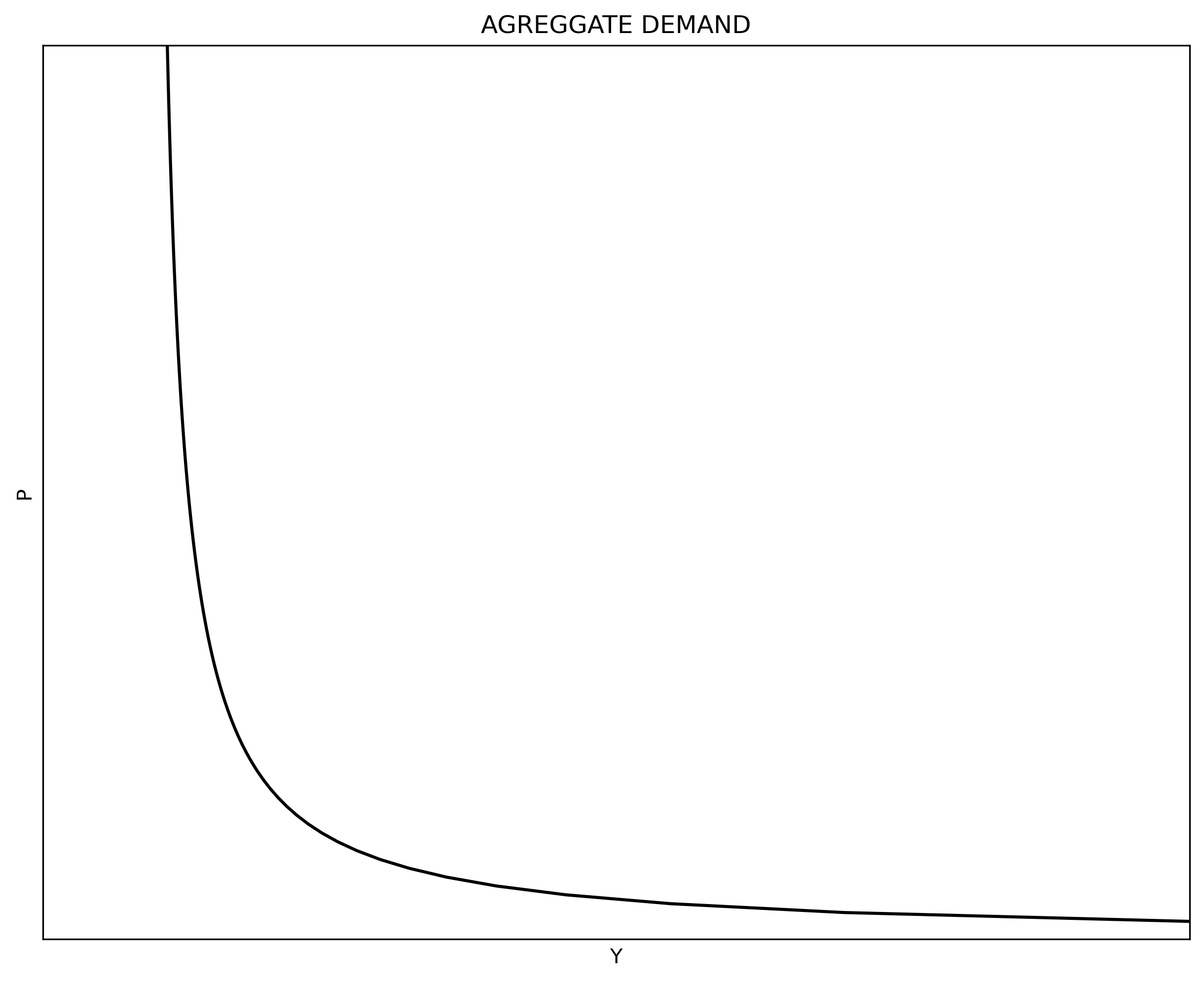

Long-run aggregate supply (LRAS)

Prices are flexible in the long-run, therefore money is neutral in the long-run and the $LRAS$ is a vertical line (a given value of $Y$ rather than a function of the price level). The valor of $Y$ in the long-run can be derived from the Solow model’s steady-state. From the Solow model notes we know that there is an equilibrium level of capital $K^*$. Therefore, assuming a typical Cobb-Douglass production function with constant returns to scale, for any period of time $t$, output in the long run $(Y_{LR})$ equals:

$$ \begin{align} K_{LR} &= N \cdot \left(\frac{sA}{\delta} \right)^{\frac{1}{1-\theta}} \\[10pt] Y_{LR} &= A \cdot \left(K_{LR}^{\theta} N^{1-\theta} \right) \end{align} $$

Where $A$ is technology or total factor productivity (TFP), $N$ is labor, and $\theta$ is the output elasticity of capital. In the long-run, the leve of output will grow at the rate of growth of population $(n)$ and technology $(\gamma)$. This is shown as a right-ward movement in the common pictorial depiction of the AD-AS model. Also note that since th $LRAS$ is a value (a vertical line), it can only shift left or right, but not up or down.

Short-run aggregate supply (SRAS)

As long as wages are sticky, then changes in $P$ have short-run effects on the level of $Y$ through changes in the real wage $(W/P)$. In the long-run $N$ is at full employment and the representative firm can change the size of $K$. But in the short-run, the firm can change $N$ but $K$ is fixed. Therefore, to construct the $SRAS$ we need the behavior of labor supply in the short-run. For simplicity, this note takes a simple approach. It assumes a closed economy (you can try to add a foreign sector yourself) and lets the level of employment be defined by the following function with respect to the price level (you can try to replace with a labor market as discussed in the labor market notes):

$$ \begin{equation} N = \eta P^{\nu}; \quad \eta, \nu > 0 \end{equation} $$

The function is (implicitly) assuming constant expectations by labor. Therefore, an increase in the price level reduces the real wage paid by the firms but labor does not immediately realize that the real wage has decreased.

Putting it all together

We can now put all the pieces together. In this case, instead of using a class the sample code uses functions. The model assumes a given stock of capital $K = \bar{K}$ (you can try to add a steady-state level of capital as discussed in the Solow Model notes. The code uses the root function to find the price level of equilibrium.

#%% *** CELL 2 ***

"============================================================================"

"7|DEFINE PARAMETERS"

# PRODUCTION FUNCTION

A = 1 # Total Factor Productivity

K = 100 # Capital stock

varphi = 0.70 # Output elasticity of capital

# LABOR SUPPLY

w_s = 0.75 # Labor supply "slope" with respect to P

# MONEY SUPPLY

B = 100 # Base Money

lmbda = 0.05 # Currency drain

rho = 0.20 # Reserve ratio

# AGGREGATE DEMAND

a = 40 # Autonomous household domestic consumption

b = 0.3 # Marginal propensity to consume

T = 1 # Taxes

I = 4 # Investment with i = 0

G = 2 # Government Spengin

d = 2 # Slope of investment with respect to i

c1 = 200 # Money demand: Precuationary

c2 = 0.6 # Money demand: Transactions

c3 = 10 # Money demand: Speculation

"============================================================================"

"8|FUNCTIONS"

# LABOR SUPPLY

def N(P):

N = w_s * P

return N

# OUTPUT

def output(P):

output = A * (K**(varphi)) * (N(P)**(1-varphi))

return output

# MONEY SUPPLY

m = (1+lmbda)/(rho+lmbda) # Money Multiplier

M = B*m # Money Supply

# AGGREGATE DEMAND

def AD(P):

AD_level1 = (a-b*T + I + G)/d - (c1/c3)

AD_level2 = ((1-b)/d - (c2/c3))**(-1)

AD_shape = M/c3 * AD_level2

AD = AD_level1 * AD_level2 + AD_shape/P

return AD

"============================================================================"

"9|EQUILIBRIUM: PRICE LEVEL"

def equation(P):

Eq1 = AD(P) - output(N(P))

equation = Eq1

return equation

sol = root(equation, 10)

Pstar = sol.x

Nstar = N(Pstar)

# #Define domain of the model

size = np.round(Pstar, 0)*2

P_vector = np.linspace(1, size, 500) # 500 dots between 1 and size

# Agregate Supply and Aggregate Demand

LRAS = output(N(Pstar))

SRAS = output(N(P_vector))

AD_vector = AD(P_vector)

"============================================================================"

"10|PLOT AD-AS MODEL"

### AXIS RANGE

axis_range = [0, 80, 0, size]

### BUILD PLOT

fig, ax = plt.subplots(figsize=(10, 8), dpi=dpi)

ax.set(title="AD-AS MODEL", ylabel=r'$P$', xlabel="Output")

plt.plot(AD_vector, P_vector, "k-", alpha = 0.7)

plt.plot(SRAS , P_vector, "b-", alpha = 0.7)

plt.axvline(x = LRAS, color = 'r', alpha = 0.7)

plt.axhline(y = Pstar, xmax = LRAS/80, ls=':', color='k')

### AXIS

ax.yaxis.set_major_locator(plt.NullLocator()) # Hide ticks

ax.xaxis.set_major_locator(plt.NullLocator()) # Hide ticks

### LABELS

plt.text(75, 2.5, "AD")

plt.text(45, 11.0, "SRAS", color='b')

plt.text(30, 11.0, "LRAS", color='r')

### SETTINGS

plt.axis(axis_range)

plt.show()

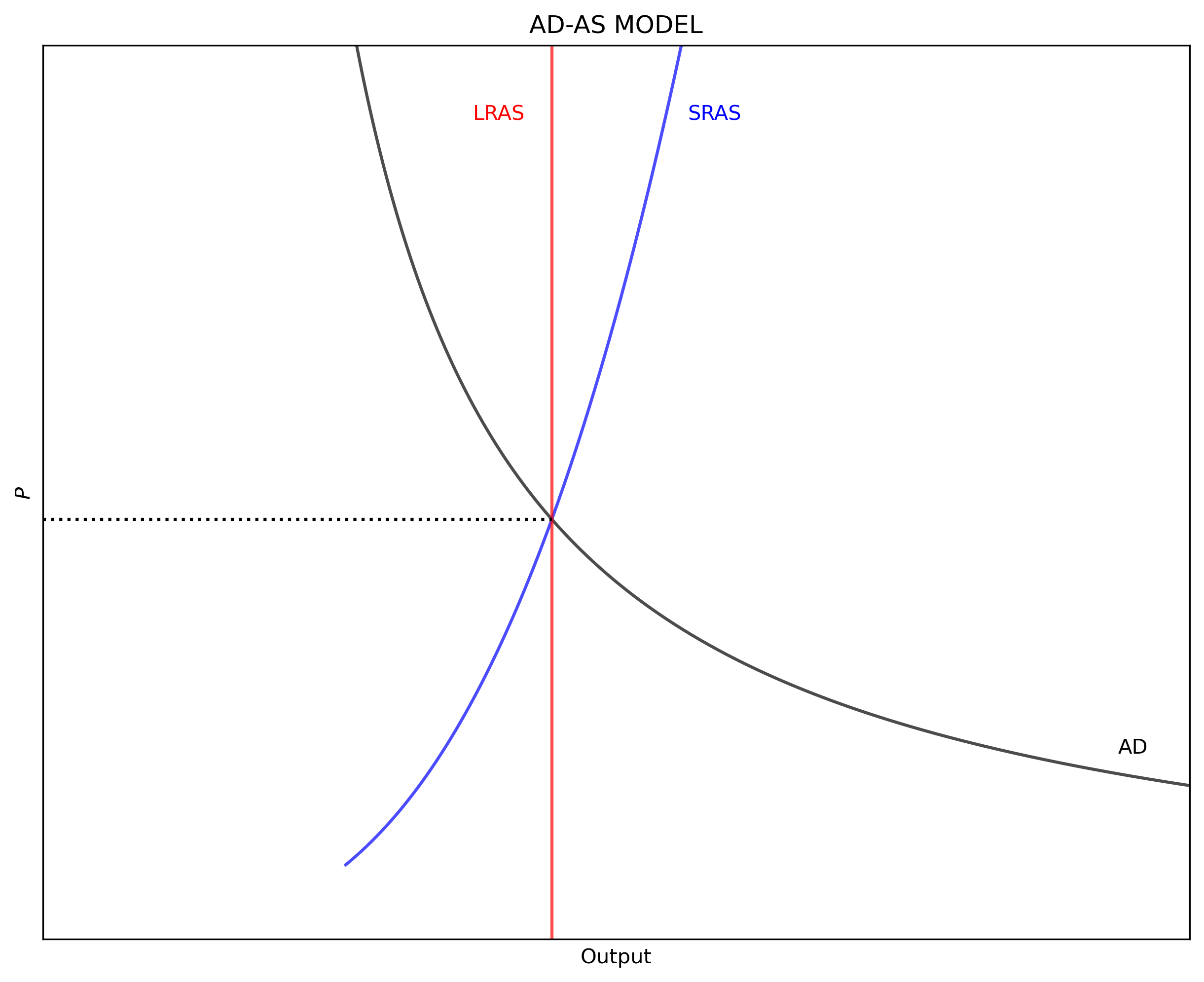

Shocks

We now add a real and a nominal positive shocks. In the case of the real shock, technology increases by 10-percent. In the case of the nominal shock, base money increases by 10-percent. The code includes the inflation rate and the percent change in output calculations for each one of the two shocks. Note that the $SRAS$ shifts horizontally with shocks to the $LRAS$.

#%% *** CELL 3 ***

"============================================================================"

"11|CALCULATE SHOCK EFFECTS"

real_shock = 1.10

nominal_shock = 1.10

# Real shock

def output2(P):

A2 = A * real_shock

output2 = A2 * (K**(varphi)) * (N(P)**(1-varphi))

return output2

def equation_real(P):

Eq1 = AD(P) - output2(N(P))

equation_real = Eq1

return equation_real

sol_real = root(equation_real, 10)

Pstar2 = sol_real.x

Nstar2 = N(Pstar2)

LRAS2 = output2(N(Pstar2))

SRAS2 = output2(N(P_vector))

gP2 = Pstar2/Pstar - 1 # Percent change in P

gY2 = LRAS2/LRAS - 1 # Percent change in Y

# Nominal shock

M3 = (B * nominal_shock) * m

def AD3(P):

AD_level1 = (a-b*T + I + G)/d - (c1/c3)

AD_level2 = ((1-b)/d - (c2/c3))**(-1)

AD_shape = M3/c3 * AD_level2

AD3 = AD_level1 * AD_level2 + AD_shape/P

return AD3

def equation_nominal(P):

Eq1 = AD3(P) - output(N(P))

equation_nominal = Eq1

return equation_nominal

sol_nominal = root(equation_nominal, 10)

Pstar3 = sol_nominal.x

Nstar3 = N(Pstar3)

AD_vector3 = AD3(P_vector)

gP3 = Pstar3/Pstar - 1 # Percent change in P

gY3 = output(Pstar3)/output(Pstar) - 1 # Percent change in Y

"============================================================================"

"12|PLOT AD-AS MODEL WITH SHOCKS"

P3_stop = output(N(Pstar3))

### AXIS RANGE

axis_range = [0, 80, 0, size]

### BUILD PLOT

fig, ax = plt.subplots(nrows=2, figsize=(10, 20), dpi=dpi)

### SUBPLOT 1

ax[0].set(title="AD-AS MODEL: REAL SHOCK", ylabel=r'$P$', xlabel="Output")

ax[0].plot(AD_vector , P_vector, "k-", alpha = 0.7)

ax[0].plot(SRAS , P_vector, "b-", alpha = 0.7)

ax[0].plot(SRAS2 , P_vector, "b:", alpha = 0.7)

ax[0].axvline(x = LRAS , ls="-", color='r', alpha = 0.7)

ax[0].axvline(x = LRAS2 , ls=":", color="r", alpha = 0.7)

ax[0].axhline(y = Pstar , xmax = LRAS/80 , ls=":", color="k", alpha = 0.7)

ax[0].axhline(y = Pstar2, xmax = LRAS2/80, ls=":", color="k", alpha = 0.7)

### SUBPLOT 1: LABELS

ax[0].text(75.0, 2.5, "AD")

ax[0].text(44.5, 11.5, "SRAS" , color = "b")

ax[0].text(48.0, 11.0 , "SRAS'", color = "b")

ax[0].text(30.0, 11.0, "LRAS" , color = "r")

ax[0].text(39.0, 11.0, "LRAS'", color = "r")

### SUBPLOT 1: AXIS

ax[0].yaxis.set_major_locator(plt.NullLocator()) # Hide ticks

ax[0].xaxis.set_major_locator(plt.NullLocator()) # Hide ticks

### SUBPLOT 1: SETTINGS

ax[0].axis(axis_range)

### SUIBPLOT 2

ax[1].set(title="AD-AS MODEL: NOMINAL SHOCK", ylabel=r'$P$', xlabel="Output")

ax[1].plot(AD_vector , P_vector, "k-", alpha = 0.7)

ax[1].plot(AD_vector3 , P_vector, "k:", alpha = 0.7)

ax[1].plot(SRAS , P_vector, "b-", alpha = 0.7)

ax[1].axvline(x = LRAS , ls="-", color="r", alpha = 0.7)

ax[1].axhline(y = Pstar , xmax = LRAS/80, ls=":", color="k", alpha = 0.7)

ax[1].axhline(y = Pstar3, xmax = P3_stop/80, ls=":", color="k", alpha = 0.7)

### SUBPLOT 2: LABELS

ax[1].text(75, 1.7, "AD")

ax[1].text(75, 2.7, "AD'")

ax[1].text(45, 11.0, "SRAS" , color = "b")

ax[1].text(30, 11.0, "LRAS" , color = "r")

### SUBPLOT 2: AXIS

ax[1].yaxis.set_major_locator(plt.NullLocator()) # Hide ticks

ax[1].xaxis.set_major_locator(plt.NullLocator()) # Hide ticks

### SUBPLOT 2: SETTINGS

ax[1].axis(axis_range)

plt.show()